One item is omitted in each of the following summaries of balance sheet and income statement data for the following four different corporations:

Freeman heyward Jones Ramirez Beginning of the year: Assets$ 900,000 $490,000 $115,000 (d) Liabilities360,000 260,000 81,000 $120,000 End of the year: Assets1,260,000 675,000 100,000 270,000 Liabilities330,000 220,000 80,000 136,000 During the year: Additional common stock issued (a) 150,000 10,000 55,000 Dividends 75,000 32,000 (c) 39,000 Revenue570,000 (b) 115,000 115,000 Expenses240,000 128,000 122,500 128,000

Determine the missing amounts, identifying them by letter. (Hint: First determine the amount of increase or decrease in stockholders’ equity during the year.)

Answer:

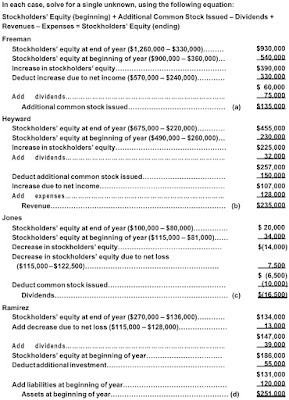

In each case, solve for a single unknown, using the following equation:

Stockholders’ Equity (beginning) + Additional Common Stock Issued – Dividends +

Revenues – Expenses = Stockholders’ Equity (ending)

Freeman

Stockholders’ equity at end of year ($1,260,000 – $330,000)……… $930,000

Stockholders’ equity at beginning of year ($900,000 – $360,000)… 540,000

Increasein stockholders’ equity………………………………………… $390,000

Deduct increase due to net income ($570,000 – $240,000)………… 330,000

$ 60,000

Add dividends………………………………………………….…………… 75,000

Additional common stockissued…………………………………… (a) $135,000

Heyward

Stockholders’ equity at end of year ($675,000 – $220,000)………… $455,000

Stockholders’ equity at beginning of year ($490,000 – $260,000)… 230,000

Increasein stockholders’ equity………………………………………… $225,000

Add dividends………………………………………………….…………… 32,000

$257,000

Deduct additional common stock issued……………………………… 150,000

Increase due to net income……………………………………………… $107,000

Add expenses………………………………………………….…………… 128,000

Revenue………………………………………………….……………… (b) $235,000

Jones

Stockholders’ equity at end of year ($100,000 – $80,000)…………… $ 20,000

Stockholders’ equity at beginning of year ($115,000 – $81,000)…… 34,000

Decreasein stockholders’ equity……………………………………… $(14,000)

Decrease in stockholders’ equity due to net loss

($115,000 – $122,500)………………………………………………….

7,500

$ (6,500)

Deduct common stockissued…………………………………………… (10,000)

Dividends………………………………………………………………… (c) $(16,500)

Ramirez

Stockholders’ equity at end of year ($270,000 – $136,000)………… $134,000

Add decrease due to net loss ($115,000 – $128,000)………………… 13,000

$147,000

Add dividends………………………………………………….…………… 39,000

Stockholders’ equity at beginning of year…………………………… $186,000

Deduct additionalinvestment…………………………………………… 55,000

$131,000

Add liabilities at beginning of year……………………………………… 120,000

Assets at beginning of year…………………………………………… (d) $251,000

No comments:

Post a Comment