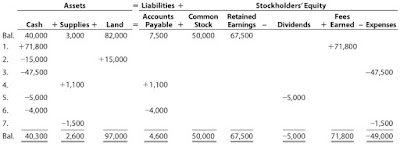

Teri West operates her own catering service. Summary financial data for July are presented in equation form as follows. Each line designated by a number indicates the effect of a transaction on the equation. Each increase and decrease in stockholders’ equity, except transaction (5), affects net income.

Assets 5 Liabilities 1 Stockholders’ Equity Cash 1 Supplies 1 Land 5 Accounts Payable 1 Common Stock Retained Earnings − dividends 1 Fees Earned − Expenses Bal. 40,000 3,000 82,000 7,500 50,000 67,500 1. +71,800+71,800 2. –15,000 +15,000 3. –47,500−47,500 4. +1,100 +1,100 5. –5,000–5,000 6. –4,000 –4,000 7. –1,500–1,500 Bal. 40,300 2,600 97,000 4,600 50,000 67,500 –5,000 71,800 –49,000

a. Describe each transaction.

b. What is the amount of the net increase in cash during the month?

c. What is the amount of the net increase in stockholders’ equity during the month?

d. What is the amount of the net income for the month?

e. How much of the net income for the month was retained in the business?

Answer:

a.

(1) Provided catering services for cash, $71,800.

(2) Purchase of land for cash, $15,000.

(3) Payment of cash for expenses, $47,500.

(4) Purchase of supplies on account, $1,100.

(5) Paid cash dividends, $5,000.

(6) Payment of cash to creditors, $4,000.

(7) Recognition of cost of supplies used, $1,500.

b. $300 ($40,300 – $40,000)

c. $17,800 (–$5,000 + $71,800 – $49,000)

d. $22,800 ($71,800 – $49,000)

e. $17,800 ($22,800 – $5,000)

No comments:

Post a Comment