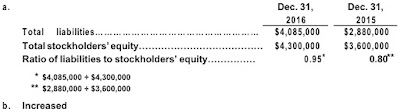

The following data were taken from Alvarado Company’s balance sheet:

dec. 31, 2016 | dec. 31, 2015

Total liabilities $4,085,000 | $2,880,000

Total stockholders’ equity. 4,300,000 | 3,600,000

a. Compute the ratio of liabilities to stockholders’ equity.

b. Has the creditor’s risk increased or decreased from December 31, 2015, to December 31, 2016?

Answer:

a. Dec. 31, Dec. 31,

2016 2015

Total liabilities……………………………………………… $4,085,000 $2,880,000

Total stockholders’ equity………………………………… $4,300,000 $3,600,000

Ratio of liabilities to stockholders’ equity…………… 0.95*

* $4,085,000 ÷ $4,300,000

** $2,880,000 ÷ $3,600,000

b. Increased