On April 1 of the current year, Andrea Byrd established a business to manage rental property. She completed the following transactions during April:

a. Opened a business bank account with a deposit of $45,000 in exchange for common stock.

b. Purchased office supplies on account, $2,000.

c. Received cash from fees earned for managing rental property, $8,500.

d. Paid rent on office and equipment for the month, $5,000.

e. Paid creditors on account, $1,375.

f. Billed customers for fees earned for managing rental property, $11,250.

g. Paid automobile expenses (including rental charges) for month, $840, and miscellaneous expenses, $900.

h. Paid office salaries, $3,600.

i. Determined that the cost of supplies on hand was $550; therefore, the cost of supplies used was $1,450.

j. Paid dividends, $2,000.

Instructions

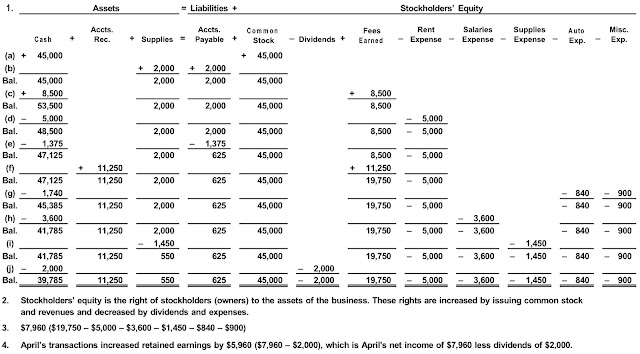

1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings:

Assets 5Liabilities1 Stockholders’ Equity Accounts Cash + Receivable + Supplies= Accounts Payable + Common Stock – Dividends + Fees Earned – Rent Expense – Salaries Expense – Supplies Expense – Auto Expense –

2. Briefly explain why issuing common stock and revenues increased stockholders’ equity, while dividends and expenses decreased stockholders’ equity.

3. Determine the net income for April.

4. How much did April’s transactions increase or decrease retained earnings?

Answer:

1. Assets = Liabilities + Stockholders’ Equity Cash Accts. + Rec. + Supplies = Accts. Payable + Common Stock – Dividends + Fees Earned Rent – Expense – Salaries Expense – Supplies Expense – Auto Exp. (a) + 45,000 + 45,000 (b) + 2,000 + 2,000 Bal. 45,000 2,000 2,000 45,000 (c) + 8,500 + 8,500 Bal. 53,500 2,000 2,000 45,000 8,500 (d) – 5,000 – 5,000 Bal. 48,500 2,000 2,000 45,000 8,500 – 5,000 (e) – 1,375 – 1,375 Bal. 47,125 2,000 625 45,000 8,500 – 5,000 (f) + 11,250 + 11,250 Bal. 47,125 11,250 2,000 625 45,000 19,750 – 5,000 (g) – 1,740 – 840 – 900 Bal. 45,385 11,250 2,000 625 45,000 19,750 – 5,000 – 840 – 900 (h) – 3,600 – 3,600 Bal. 41,785 11,250 2,000 625 45,000 19,750 – 5,000 – 3,600 – 840 – 900 (i) – 1,450 – 1,450 Bal. 41,785 11,250 550 625 45,000 19,750 – 5,000 – 3,600 – 1,450 – 840 – 900 (j) – 2,000 – 2,000 Bal. 39,785 11,250 550 625 45,000 – 2,000 19,750 – 5,000 – 3,600 – 1,450 – 840 – 900 2. Stockholders’ equity is the right of stockholders (owners) to the assets of the business. These rights are increased by issuing common stock and revenues and decreased by dividends and expenses. 3. $7,960 ($19,750 – $5,000 – $3,600 – $1,450 – $840 – $900) 4. April’s transactions increased retained earnings by $5,960 ($7,960 – $2,000), which is April's net income of $7,960 less dividends of $2,000.

The answer to number 4. Is NOT 5960

ReplyDeleteIt’s 50960

I never thought that I will be qualify for a loan that Officer Pedro and his loan company granted me which was very smooth and transparent in every conversation that we make through the loan process, I will once again thank him and his loan organization for a job well done by offering me a loan of 22 million Euro with the low rate of 2% annual return they are genuine and loan register company with simple terms and conditions.Contact the loan company through pedroloanss@gmail.com

ReplyDelete